Want to kick-start your music career?

30% off specialist music insurance*

Rising Stars

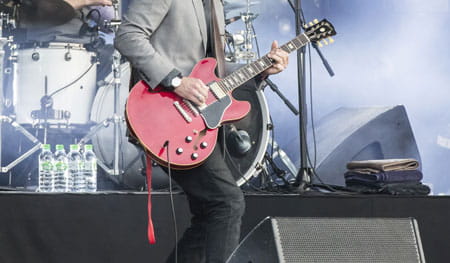

Here at musicGuard we love live performance. Whether it is going to see Taylor Swift pack out a Stadium, an orchestra in a symphony hall, or a local DIY punk band in in a local pub, there is nothing like the experience of being in an audience watching the magic happen.

Except maybe being on stage…

As the festival season draws to a close, across the country thousands are looking back on those amazing experiences and thinking ‘that could be me next year!” And at musicGuard we want to help those rising stars.

Now, we’re an insurance company. We can sometimes give you some pointers, but we can’t book your first gig, or build your fanbase, but we can at least make sure getting insurance isn’t going to be a barrier to stardom! That’s why we’re offering 30% off on all musicGuard policies – whether you’re just getting started as a musician, or are one of the best known faces on the circuit! The discount available for new customers only who apply online. Discount will be automatically applied and can be changed or withdrawn at any time.

Over 20 years of Guardcover, supporting your passion

Why protect your instruments with musicGuard?

See what our specialist cover can offer musicians and their instruments at musicGuard.

20 Years of Experience

We know what it takes to protect the things that matter to you.

Quick and Simple

It only takes a couple of minutes to get a quick and easy quote.

0% Monthly Payment

Spread your payments across the year at no extra cost.

UK Customer Service

Our customer service team is ready to help you with all your questions.

Online Account

Your online account is an easy way to access and manage your policies 24/7.

Specialist Insurance

Cover for all types of musicians from teaching, rehearsing or performing live.

Specialist music insurance from musicGuard

What am I covered for?

We know how important your music equipment is, so if you like to play in your spare time, we can provide you with the cover you need to keep you rocking.

-

Theft and Accidental Damage

What happens if your music equipment is damaged?

If your music equipment is stolen from your home or studio or has suffered damage, musicGuard is there to help you. Our cover includes theft and accidental damage, vandalism, and attempted theft. Security requirements apply.

-

New for Old Cover

How can we replace your music equipment?

We understand what your music equipment means to you, which is why we offer genuine new for old replacement. As long as you’re able to demonstrate the original value, then we won’t depreciate the value of your equipment.

-

Cover Abroad

Got a gig overseas?

If your latest gig takes you abroad or your music equipment just simply goes where you go, no problem. We automatically include UK-wide cover and up to 30 days of worldwide cover for your insured equipment. Our optional Global Travel cover can take you and your kit abroad for longer with 365 days worldwide cover (Public Liability excludes United States of America and Canada).

-

In-Vehicle Cover

Is your music equipment covered while it's in your car?

Keep your music equipment safe when you're on the road. We automatically include In-Vehicle Cover and up to £300 cover for damage caused to your vehicle at the same time as the theft or attempted theft of your insured equipment. Storage and vehicle security requirements apply, cover is not applicable when the vehicle is at your insured location.

-

£100,000 Legal Expenses Cover

How can we help if you're involved in a legal dispute?

All our policies now include extra legal protection through our Legal Expenses cover, which is automatically included with all our policies purchased or renewed after 23rd June 2024.

We provide up to £100,000 of legal expenses cover, within the UK, for incidents related to certain contract and tax disputes, as well as legal defence work. In addition, we also include our Legal & Tax Advice helpline and online support through our Business & Consumer Legal Services portal.

-

Loss of Earnings

How can we support you?

If you’ve had an accident that's keeping you from performing, then you shouldn't have to be out of pocket. We can offer you:

- £800, or

- 75% of your lost music related earnings (whichever is lesser)

Cover only applies to pre-booked music related earnings.

-

£2,000 Equipment Hire

What if you need to rent music equipment?

If you’re making a claim with us but still need replacement equipment, then don’t worry. It’s covered as part of our claims service, with up to £2,000 of equipment hire available if you need it - we’ll just need to approve it before you do. Cover applies in the UK, with up to £250 claims hire cover abroad available with our optional Global Travel cover.

Your policy document explorer

For customers whose policy started before 1st January 2021, you can access your policy documents here.

Existing customers: If you have an existing policy before September 23rd 2019, then you can contact our team for information on your policy.

You can email us at: support@guardcover.co.uk or call us on: 0333 004 3888