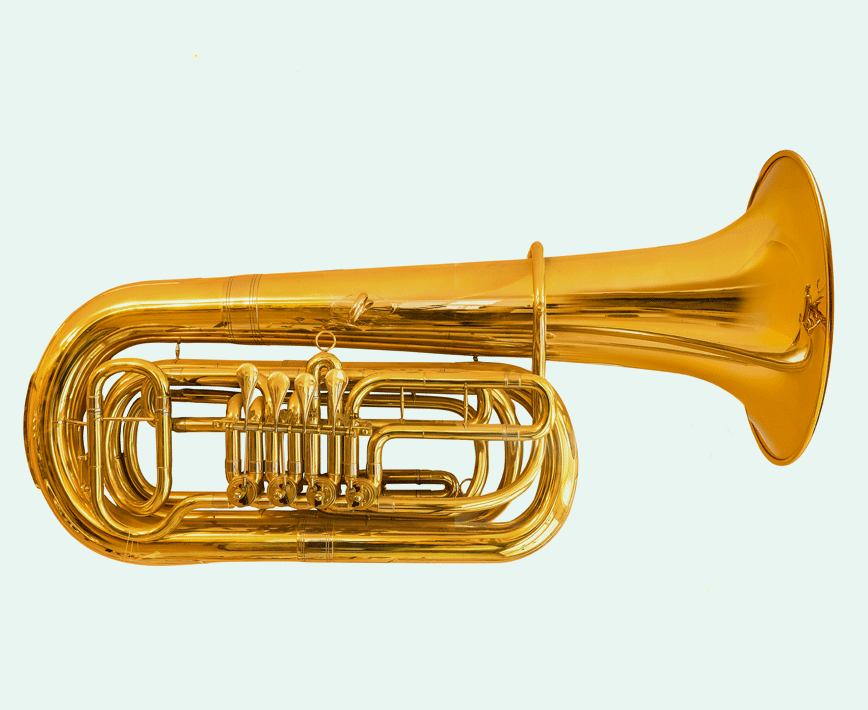

Our cover

Flexible protection for your instruments

Our musical instrument insurance explained

See what specialist cover we can offer you

At musicGuard, we can provide both protection and security for your musical equipment, not only to help keep your instruments safe, but you as well. Your instruments will be covered against accidental damage, theft, and we can even help with the cost of a replacement should you need one.

Frequently asked questions about music insurance

Want to find out more about our music cover?

If you’re wondering what our music insurance includes, then we’ve answered a few questions here!

- Cover

- Security

- Travel

- What is Public Liability insurance?

Public Liability (also referred to as personal liability or Third Party Liability) provides cover for any music-related legal liability that results in an injury to someone or damage to their property and where you are held liable.

For more information on our Public Liability cover for musicians and what Public Liability cover can protect you against, you can consult our policy wording here.

- Do I need Public Liability insurance before I start playing gigs?

Many venue owners may require musicians to have Public Liability insurance before they can play gigs. Public Liability insurance can cover you if you were to hurt someone or damage their property while you’re performing and for which you are then held liable.

- Can I include others on my insurance cover?

When you are insuring your instruments; the policy would have to be in one person's name and this person would automatically get £1million of Public Liability. For an additional premium you can increase your Public Liability cover to £5million or £10million and include up to four additional band or group members who help support you in your music.

- Do you cover mobile or smart phones?

Unfortunately, we are unable to cover any mobile or smart phones on our music insurance.

- Can I get insurance for a one-off event or just for a few days or weeks?

Our musical insurance is provided on an annual basis, we do not offer any cover on a short term or temporary basis.

- How do you determine a like for like basis, should the item not be repairable?

Any offer we make to you will be determined by the features and specification of the insured item claimed for. This is based on the current market equivalent for products of a similar quality and specification and not the original cost of the item.

- If I choose the Mechanical Breakdown option, is all of my equipment covered?

Our Mechanical Breakdown option provides cover for repair costs to electrical instruments and equipment that you purchased from new, are no more than five years old and are outside of any other warranty. Unfortunately, we are unable to cover laptops, tablets, desktop computing equipment and related accessories with this cover option.

- What value should I insure my instruments for?

For items that can be readily replaced with a new one (or with a similar model), the value should be the usual, undiscounted cost including VAT from a reputable retailer at the time you apply.

- Can I get cover for any music-related Loss of Earnings?

Yes, our policy can cover pre-booked music related loss of earnings that are as a direct result of bodily injury caused by an accident that prevents you from attending either: your music-related profession, events, or any lessons.

We can cover up to £800 or 75% of pre-booked music-related events that you are no longer able to attend. Please refer to your policy wording for full terms and conditions.

- What is the minimum / maximum age to get cover?

The minimum age for the main policyholder is 18. Public Liability and Personal Accident cover (if you have chosen to include this on your policy) will only apply to anyone aged 16 or over at the time of any incident, and total permanent disablement cover is only available for anyone aged 65 or under.

- Can you cover two addresses on the one policy?

If you need to cover your instruments at more than one address, please call our contact centre on: 0333 004 3888

We can then look to update the policy accordingly dependent on the policy and security requirements.

- Can I set up a policy on behalf of someone else?

As the insurance policy is a legal agreement between us and the policyholder, we can only set up a policy with the person who will be named as the policyholder.

- How can I pay for my policy?

You can choose to pay in full by credit or debit card. Alternatively, you can take advantage of our interest free monthly payment option and simply spread the payments out, without any additional cost.

- Can I add or make changes to the policy at any time?

Yes, you can make changes to your policy by simply logging in to your online account here, or by getting in touch with our contact centre by either:

- Phone: 0333 004 3888

- Email: support@guardcover.co.uk

You can add or delete insured items and change some aspects of your policy. Note that additions will incur additional costs. Additional premiums are charged on a pro rata basis from the date of change. Any cover options that you choose can only be added or removed when you first buy the policy or at renewal.

- Is there an excess on this policy?

All insured items claims are subject to the following excess unless otherwise stated on your insurance schedule:

- Cover for Insured Items - Excess payable = £75

- Mechanical Breakdown for Insured Items - Excess payable = £75

- Public Liability Property Claims - Excess payable = £500

- Public Liability Injury Claims - Excess payable = Nil

For Public Liability claims, the first £500 of each claim arising from damage to third party property.

- I have previously made a claim. Will this affect my cover?

You need to tell us about any music related losses or claims you have had within the last three years whether insured or not. It is important that you make an honest disclosure of any previous claims or losses, as if not this could invalidate your cover.

- Are there any security requirements for my vehicle or where my instruments are kept?

At your insured location (This is where your instruments are usually kept and should also be your main place of residence or your music business premises or studio): For cover to apply while your instruments are at your insured location, the insured items must be kept within the main structures (must be brick or stone built) of your insured location and all normal security protections are in force.

Cover in an unattended vehicle: Theft or attempted theft from a vehicle will only be covered if your insured item is stored out of sight, in an enclosed storage compartment, boot or luggage space. All vehicle doors and windows must be closed and securely locked, and all vehicle security systems activated.

All insured items need to be removed and stored inside your insured location when your vehicle is at your insured location. In-vehicle cover does not apply when the vehicle is at your insured location.

Accidental damage that occurs in a vehicle is only covered if the insured item is in a purpose-designed equipment case. If your musical instruments are in transit with an airline transport provider, see the FAQ relating to airline cover.

For any theft claims, whether at your insured location, storage location or from a vehicle, you need to report the incident to the police and there must be evidence of forcible and/or violent entry or evidence of unauthorised access.

- Am I covered to take my instruments abroad?

This depends on the options you choose. Included as standard with your policy, you are covered to take your musical instruments anywhere in the UK and up to 30 days worldwide in total during your period of insurance. If you need more extensive cover, you can choose our Global Travel option, which will extend your worldwide cover for the full policy period.

Whilst in transit, and under the responsibility of your transport provider, your gear isn’t covered if it is stolen and accidental damage cover only applies if your musical instruments are in a purpose-built storage case.

- If I’m travelling on an airline with my instruments, am I covered?

Provided your musical instruments are in a rigid-bodied, purpose designed equipment case, they are covered for accidental damage. We regret that loss of baggage containing your instruments or theft of an insured item whilst under the responsibility of a transport provider is not covered with musicGuard.

Making a claim with musicGuard

We’ve made making a claim so easy

If your music equipment has been stolen or damaged, we know how distressing it can be. That's why we'll do everything possible to deal with your claim promptly. Our easy-to-use claims process is listed below with some helpful information regarding what to do if you need to make a claim.

1. Call the police

If you’ve been the victim of theft or malicious damage, your first port of call should be to inform the police.

2. Contact our claims team

Contact our in-house UK team to make your claim.

You can call us on: 0333 004 1999 to get started, or alternatively, you can email us with details of your claim at: claims@guardcover.co.uk

3. Make your claim

We'll provide you with your claim reference and talk you through the next steps. Should we need any further information to help process your claim, we can explain what's needed and support you.

Your policy document explorer

For customers whose policy started before 1st January 2021, you can access your policy documents here.

Existing customers: If you have an existing policy before September 23rd 2019, then you can contact our team for information on your policy.

You can email us at: support@guardcover.co.uk or call us on: 0333 004 3888